Bull Flag

The Bull Flag is a technical standard that provides the right entry to participate in a strong promotion. Many professional traders use this trend to find the best place to trade. It is important to note that bullish flag patterns are good for cryptocurrency market conditions because of the powerful patterns that sophisticated traders can benefit from.

Whether you want to use this standard pattern for day trading or swing trading, it works well. The standard pattern is useful for trading after a break or during a strong market trend.

In short, the main purpose of the bull flag pattern is to help you participate in the current stock market. This means that you can use the information provided to determine the entry level where the risk is the lowest and the reward is possible.

Visually, this pattern has a strong upward movement (tree) and then a combination that takes the form of a banner.

Structure of the Bull flag pattern

A standard flag is one that has parallel lines in the supporting movement. When these lines meet at the top, it is called a bull pennant. Traders can use the following methods to determine the value of the bull flag:

Understand the standard deviation, which is a sharp trend that moves forward, followed by an increase in volume as the market reacts to the price movement.

If the stock continues to move in the direction of consolidation, the chart will not produce a bullish flag pattern since the direction of the flag has changed. On the other hand, if the arrow is in front of the mast, the flag has been found.

Usually, traders place their orders immediately after the price movement from the standard. Usually, the profit target is calculated using the mast length, but a safer method is to use the mast height.

Like many forward patterns, the Bull Flag shows more than a short pause in a larger movement. Therefore, they usually form in the middle of the last movement. Also, they arise because assets/stocks do not move in a straight line for a long time, while short periods of time show these movements.

Bull flag models: how do they work

Traders can benefit from identifying bullish flag patterns by going long and high. If an upward movement has occurred in the mast, the result is a bull flag. If the resistance of the bull flag is broken, traders can be sure that the price will continue to move the length of the stick. On the other hand, if bullish flag support is broken, traders may conclude that the structure is incorrect.

Each bull flag and bear flag is characterized by characteristics:

Standard: An area of consolidation in price action that follows and opposes previous sharp price movements. The deviation of the standard should not be more than 50% from the standard deviation.

Flagpole: The distance from where the action starts and extends to the highest or lowest point of the flag. Ascending standard stacks form higher standard values. Breakout Point: The specific point at which the asset price moves above the resistance level. Traders use stoppages to confirm standard identification and also serve as entry points for trades.

Price Analysis: The change is expected to increase the value of the price when the breakeven point is reached. Investors use valuation as part of risk reward calculations and risk management strategies.

Resistance Level: It refers to the downward resistance level that corresponds to the support level (bullish standard). On the other hand, it also represents a bullish resistance level similar to a support level (bearish flag).

Support level: It shows a support level that is decreasing at a resistance level (bullish standard), or a support level that is increasing at a resistance level (a bearish standard).

Identify the bull flag pattern

The beginning of a bull flag pattern

The market had two major waves. The first is the impulse wave and the second is the retracement wave. A stick in the form of a bullish flag represents the formation of a bullish wave. A flag in a bullish pattern indicates the formation of a bearish reverse wave. Reason criteria

But a good benchmark has specific criteria that you need to follow in order to determine the perfect trading strategy.

The flagpole should show an exciting wave

The flag should show the reverse wave. a retracement wave can follow two or three small waves. Therefore, to draw a standard pattern, you need to identify at least two small waves and a retracement. Then draw a channel that meets the high and low of the retracement

The crack of the channel must have been a large lamp with a large meat

The price is not expected to return below the 61.8% Fibonacci level. If the price returns to 78.6% of the Fibonacci level, it means that the top is weak. so we will ignore this configuration

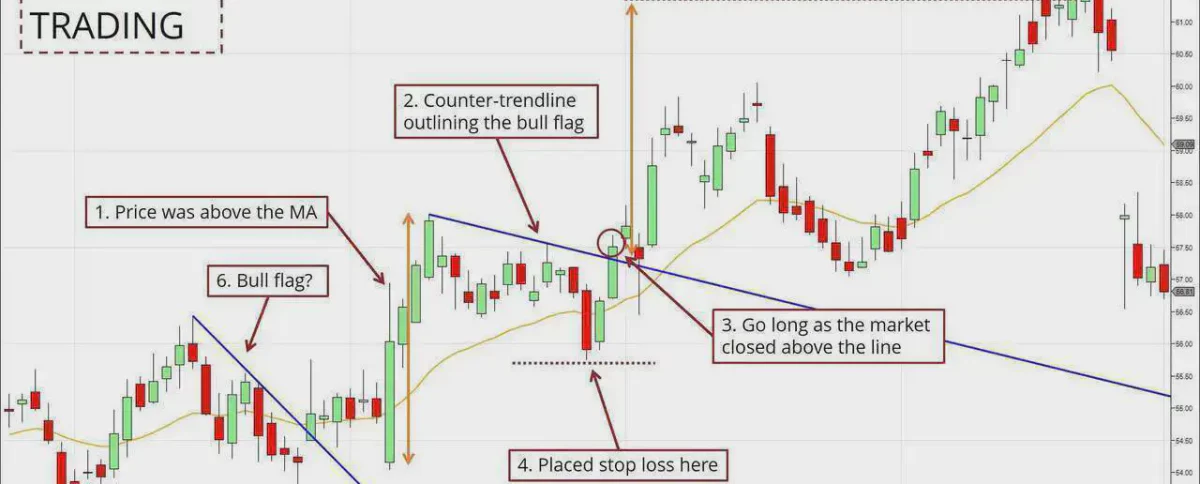

How to trade a bullish flag

The bull flag pattern is one of the many trading strategies that traders use, either to enter the market from a buy side or an opportunity to enter an existing long position.

A buy signal is created from a bullish flag when the price crosses above the trendline of the channel that is like a flag – a structure that connects the upper middle price formed during the price reversal and the stability of the flag. his eyes. On the other hand, many conservative buyers will not start buying until the pattern is confirmed by putting a price above the high price of the standard part of the pattern.

However, it should be borne in mind that waiting for the approval of the resumption of the market puts the customer at greater risk. In fact, the guideline for applying the first stop loss strategy when trading a bullish flag is to place your stop a little below the lowest price of the standard retracement. Therefore, entering the buy market when the price breaks above the standard channel invests less money than entering the market at a new price higher than the top of the standard channel.

The main thing to successfully (i.e. usefully) trade this pattern is to ensure that, first of all, everything in the pattern is there – the flagpole, the flag and the breakout in the statement. Second, make sure that all the characteristics described above about the first uptrend, price action occurs during the establishment of the standard – a series of low highs and low lows, and volume values follow it is also now.

The first profit target for bullish flag trading is usually set above the breakout point of the flag channel which represents the distance from the bottom to the top of the flag Flag Pattern

Characteristics of Flag Pattern

There are usually five parts to a bull’s-eye flag pattern:

Past Action: This is the rise of the standard deviation in the stock that shows progress in a short period of time.

Consolidation Channel: This is the area of support and resistance where the stock changes within the defined levels (standards). Volume pattern: An increase in volume is usually seen during stock price increases.

The Breakout: This is where the stock rises above the breakout level at the end of the standard. Confirmation when the price continues: The price of the stock continues in the same direction as the original mast after the break.

Advantages and disadvantages

Historical forecasting tests have shown both bullish and bearish trend patterns to be reliable, with a success rate of around 65% to 70%. Therefore, it is among the most reliable chart values for customers to use. One of the advantages of the bullish flag pattern is that it is easy to see the price correction pattern when it appears.

In addition, it allows traders to enter the market with less risk, so even if the values are not good, the trader does not risk a lot of money in the trade. Many traders are looking for strong trading signals from standard trading signals using other technical indicators.

For example, the pattern can be considered a stronger trading signal if the standard retracement extends approximately one of the Fibonacci retracement levels, such as the 23.6% or 38.2% retracement from the top of the standard bar. . On the other hand, traders may look for a minor correction to fit the trend line that represents a short-term moving price level, such as the 10 or 20 times and – a lump.

The downside of trying to buy a bull flag is that a lot of patterns are needed to create a valid buy signal. As a result, buyers may miss out on shopping opportunities because the values do not have one or more key features, but the price rises nonetheless.

Another drawback is the only drawback of all charting methods – the possibility of patterns leading to false trading signals. The price of a stock may appear to be rising from a standard, thereby attracting buyers to buy, but then come back down and fall completely above the previous high.